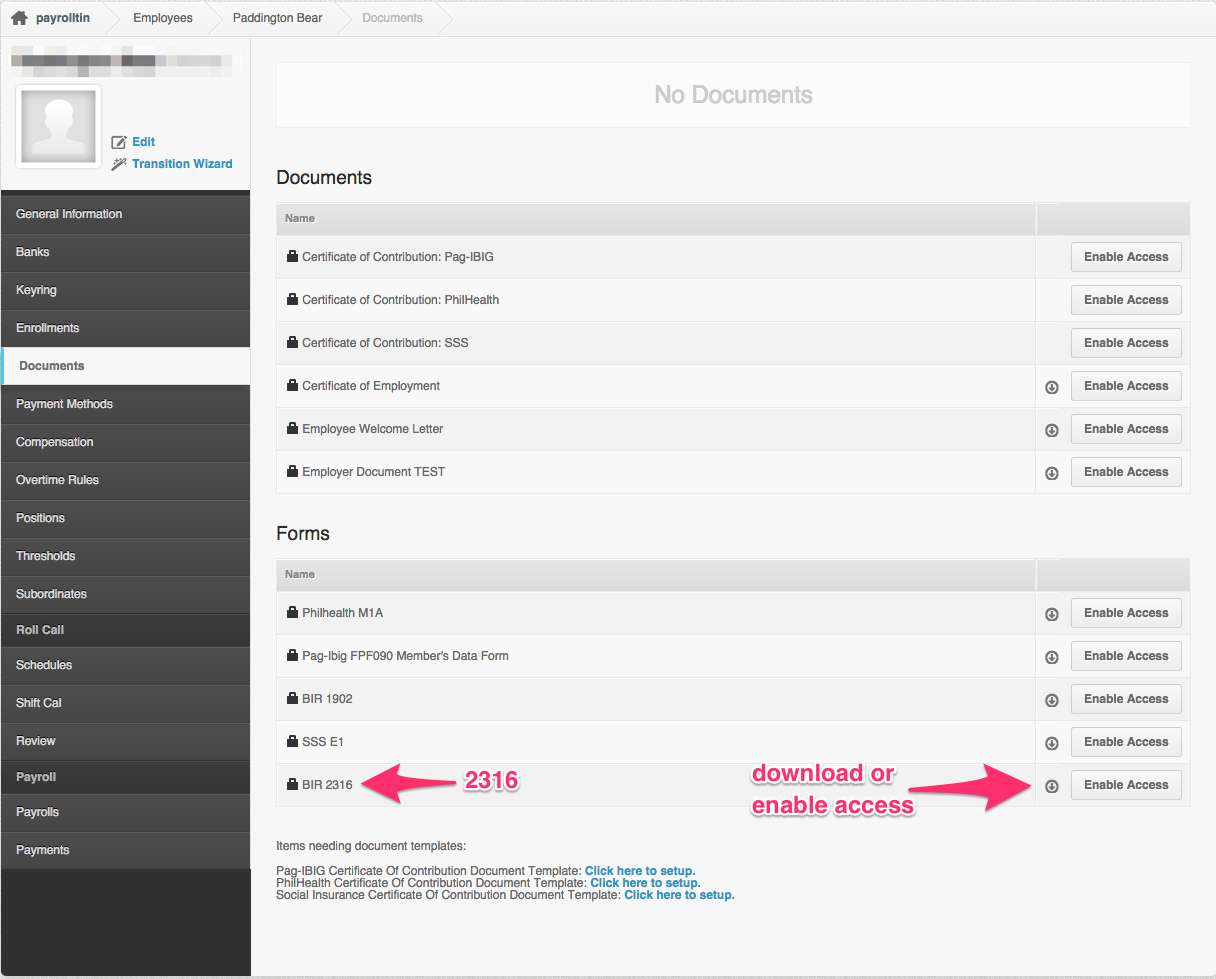

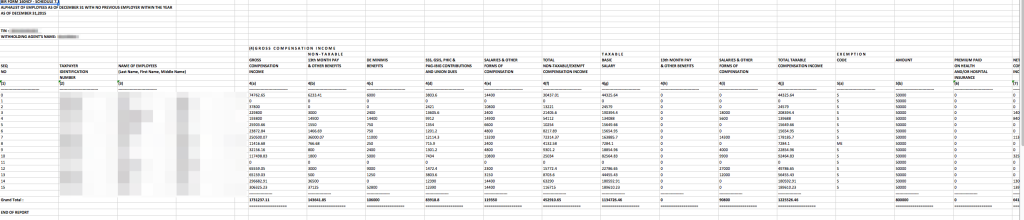

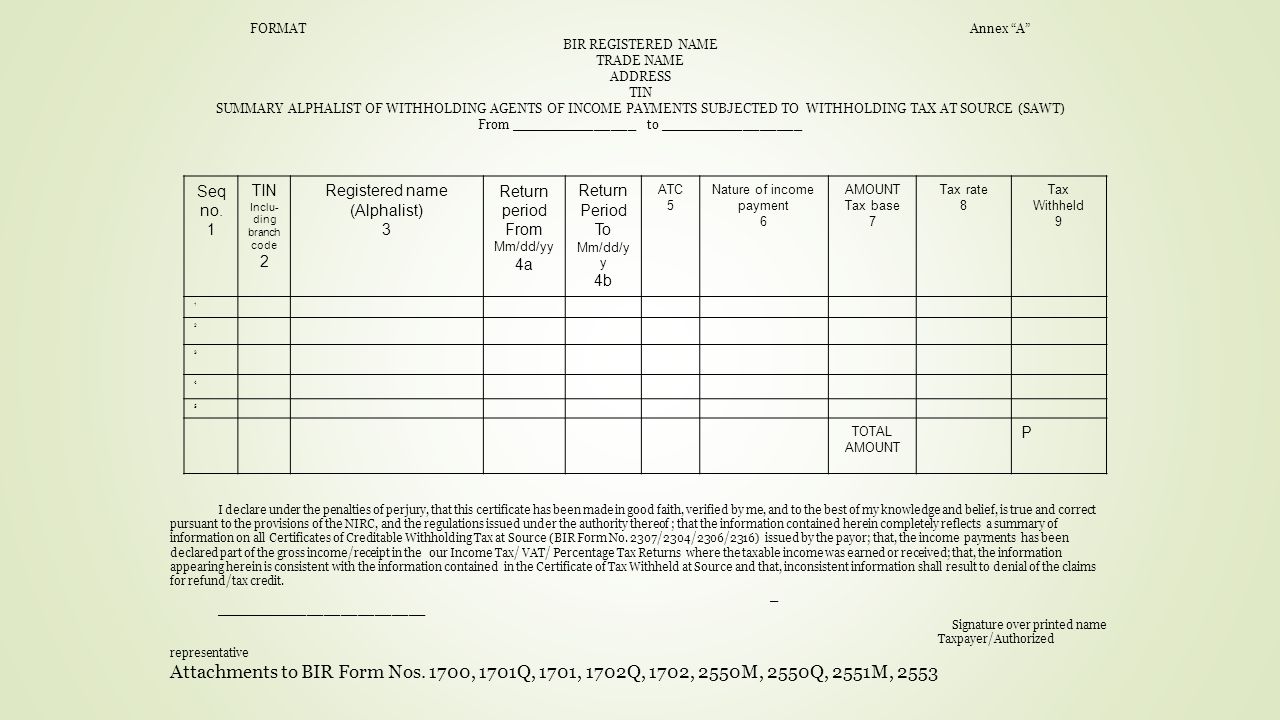

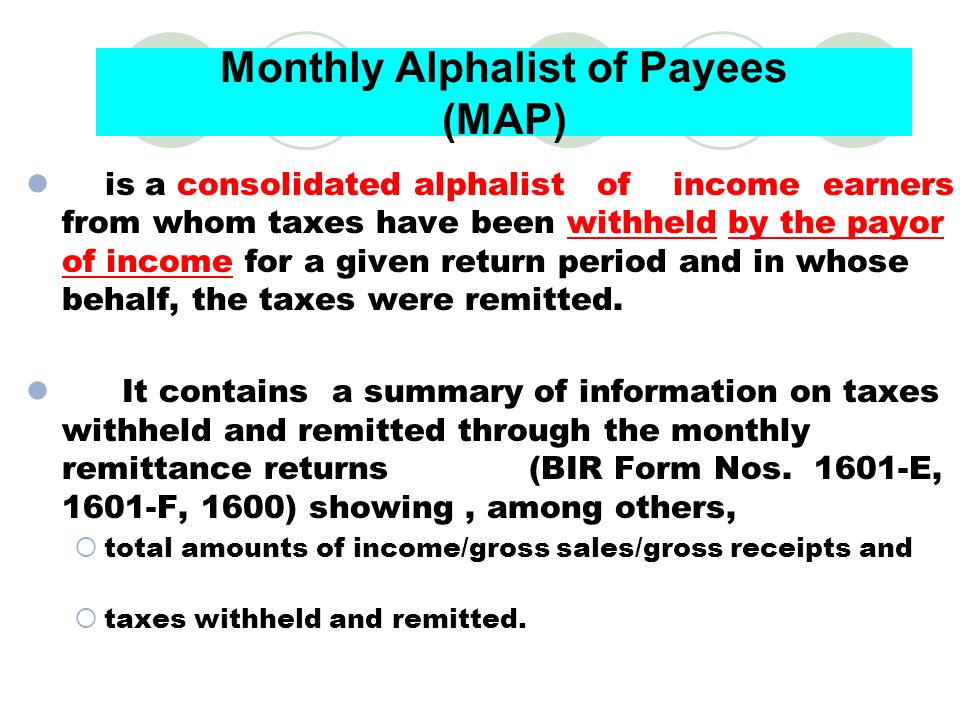

1 REPUBLIC OF THE PHILIPPINES DEPARTMENT OF FINANCE BUREAU OF INTERNAL REVENUE Quezon City December 1, 2005 REVENUE REGULATIONS NO. SUBJECT: Mandatory Attachments of the Summary Alphalist of Withholding Agents of Income Payments Subjected to Tax Withheld at Source Year End Update Philippines: Alphalist, BIR DAT Files and 2316 Forms Posted on December 8, 2015 by Nix Eniego This is one of PayrollHeros biggest releases this year. BIR Excel Uploader is a free program that enables you to generate DAT files for BIR Relief and Alphalist Data Entry System. Relief and Alphalist Data Entry System. Relief or Alphalist Data Entry. To generate BIR Alphalist Excel Format, click Generate File button on the 1601E Menu. Save As window will appear for selecting location to save BIR Alphalist Excel Format. Select directory or folder where to save the BIR Alphalist Excel Format data, then click Save button to commit save. The Bureau of Internal Revenue or Kawanihan ng Rentas Internas (BIR) is an agency of Department of Finance of the Philippines responsible for the implementation of tax laws and collection of tax. The Bureau of Internal Revenue or BIR has issued the Alphalist Data Entry System and Validation Module Version 5. 1 as described under BIR Revenue. Alphalist map sawtdejobaidver2 1. Job Aid BUREAU OF INTERNAL REVENUE Systems Development DivisionISDS Version 2 February 2006 Page 1 1. eSubmission is developed to enable the taxpayer to submit their Monthly Alphalist of Payees(MAP) and Summary Alphalist of Withholding Tax(SAWT), Summary List of Sales, Purchases and Importations(SLSPI) attachments electronically via emailweb facility. The bureau has issued BIR Alphalist Data Entry v6. 0 to update Alphalist Data Entry v5. Included in the package is the Procedures for Alphalist Data Entry v6. In another effort to enhance tax compliance in the Philippines, the Bureau of Internal Revenue (BIR) issued Revenue Regulations No. dated December 17, 2013 on submission of alphabetical list or alphalist of employees and list of payees on income payments. For Employees, ITR with BIR Received or BIR Certified True Copy Stamp Copy of Alphalist with BIR Received Stamp (Form 1604 CF). You must highlight your name on the alphalist. Hence if it is your second, third, forth time etc. to apply for a Korean visa could I assume that I. The Relief Data is a tool created by the Philippine's Bureau of Internal Revenue. This article aims to guide you in preparing and filing BIR Form 1604E Annual Information Return of Creditable Income Taxes Withheld (Expanded) Income Payments Exempt from Withholding Taxes, and Alphalist of Payees with the Bureau of Internal Revenue (BIR). An alphalist list of employees list of payees on income payments subject to creditable and final withholding taxes should be submitted to BIR. Bir Alphalist Data Entry Manual bir. Freeware The Alphalist Data Entry is a program development solution that lets you check data entry according to your own preferences. This feature is not available right now. The easiest way to convert BIR Form Excel Format to BIR Relief and Alphalist Data Entry DAT file. The Alphalist Data Entry is a downloadable application created by the BIR which was designed to help taxpayers in preparing the Alphalist of Payees when it comes to. Alphalist Data Entry and Validation version 3. 4 A guide to uninstall Alphalist Data Entry and Validation version 3. 4 from your computer Alphalist Data Entry and Validation version 3. Kindly check your email for the system generated password 2012 Copyright bir. Build Version: September 2014 Under Revenue Regulations (RR ), all employers are now required to submit a digital copy of the Alphabetical List of their employees and payees. year covered by the alphalist being validated, encode the correct taxable year in the box. Step 16 Select and open the icon for the appropriate BIR Forms (e. The BIR Alphabetical List, or alphalist is an attachment to BIR form 1604CF, and includes an alphabetical list of employees who have paid tax in line with Philippine Revenue Regulations. Alphalist Data Entry and Validation Module Version 6. 0 (New) To download the Alphalist Data Entry Validation Module Version 6. 0 just click on the following: ZIP The purpose of the 1604CF is to file the summary and adjustments of all the salaries paid to employees for the tax year. To be accompanied by an alphalist. ALPHALIST OF EMPLOYEES TERMINATED BEFORE DECEMBER 31 (Reported Under BIR Form No. 2316) (Use the same format as in Schedule 7. 3 but prepare a separate column (before Gross Compensation) for inclusive date of employment. ALPHALIST DATA ENTRY and VALIDATION is developed by the Bureau of Internal Revenue, Government of the Philippines. You can easily import and export data as DAT files using this program. This program is used to calculate the revenue and tax returns for private and publicsector companies in the Philippines. Tax Filing Reminders Page 2 Yearend Tips and Reminders OUTLINE I. Time, Place and Manner of Filing of Summary Alphalist of Withholding Agents of Income BIR Forms to be used for Income Tax filing covering and starting the taxable Alphalist Data Entry and Validation Module Version 5. 1 (New) is Now Available After installation of the BIR Alphalist 5. 1, you have to fillup your information as Withholding Agent base on the Certificate of Registration issued by the BIR. The BIR 2307 (Certificate of Creditable Tax Withheld At Source) is issued by the Payor to. Clarification on the mode of submission of alphalist. The BIR has issued the following clarifications on the submission of the alphabetical list of employees and list of payees on income payments subject to creditable and final withholding tax (alphalist) in accordance with Revenue Regulations No. Alphalist sawt mapvaljobaidver2 1. User can either validate 1600, 1601E and 1601F diskette and data files. To validate 1601E files, click Validation and. To effectively perform its collection of taxes for nationbuilding, the Bureau of Internal Revenue (BIR) recommends to the Department of Finance (DOF) the issuances of Revenue Regulations (RR. Download Alphalist Data Entry and Validation Module. Create a username and password. This attachment doesn't need to be submitted manually to BIR after submitting online. BIR Form 1604CF (ENCS) PAGE 2 Part III Alphabetical List of Employees Payees from whom Taxes were Withheld (format only) Schedule 5 ALPHALIST OF PAYEES SUBJECT TO FINAL WITHHOLDING TAX (Reported Under Form 2306) SEQ Taxpayer NAME OF PAYEES ADDRESS OF STATUS ATC NATURE OF INCOME AMOUNT OF RATE AMOUNT OF TAX NO. The AlphaList report generates an alphabetical list of employees who have paid tax in line with Philippine Revenue Regulations 1008: (Source: BIR). This report also contains information on taxes deducted by employers from their employees wages. eFPS Login: TIN: Note: Username and Password are casesensitive. Forgot password Enroll to eFPS BIR Main Help Supported Browsers: Mozilla Firefox version 40 and up; or Google Chrome version 45 and up; or Internet Explorer version 11 and up; and with 800 x 600 or higher resolution: Announcements. The Bureau of Internal Revenue (BIR) released BIR Forms 1601EQ and 1601FQ on eBIRForms version 7. 0 and Electronic Filing and Payment System (eFPS). Similarly, the Alphalist Data Entry Validation Module version 6. 0 was released by the BIR to include the QAP (Quarterly Alphalist of Payees). Download Bir Alphalist Data Entry 3. ALPHALIST DATA ENTRY and VALIDATION and 4 more programs. ALPHALIST DATA ENTRY and VALIDATION program is used to calculate the revenue and tax returns for private and publicsector companies in Philippines. The Summary Alphalist of Withholding Taxes (SAWT) as required under RR No. should be submitted through the modes prescribed under RR No. , which include: (i) eFPS, (ii) submission to BIRs website address, and (iii) email at dedicated BIR addresses using the. As common as it may seem, the Bureau of Internal Revenue (BIR) has issued certain guidelines and basic information requirements in preparing a companys alphalist. Such guidelines are released through BIR Revenue Regulations (RR). How to install the Alphalist Data Entry v5. 0 DOWNLOAD the Alphalist Data Entry and Validation Module Version 5. 0 (New) Bureau of Internal Revenue Back Description Position your mouse over a component to see its description. Next Alphalist Data Entry and Validation v5. 0 Setup Prerequisites to generate the BIR Alphalist on PayrollHero: A PayrollHero account with Payroll feature enabled. A live PayrollHero account for the full calendar year that you would like to generate Alphalist for. (For example, if you want to generate 2014, you need to have an account that has been live from January 1st 2014, until December 31st. Amendments to the Mandatory Submission of SAWT, MAP, BIR Form No. The Bureau of Internal Revenue (BIR) recently issued Revenue Regulations (RR) No. to amend the pertinent provisions of RR No. with regards to the submission of copies of BIR Form Nos. The preparation of the employee alphalists is an interdepartment effort and should not be bourne with the preparer alone. The harmony of goals towards effective preparation is a work of the Admin, HR, and Accounting Departments. Firstly, HR processes should handle the registration of employees with BIR. ALPHALIST DATA ENTRY and VALIDATION program is used to calculate the revenue and tax returns for private and publicsector companies in Philippines. It is developed by the Bureau of Internal Revenue, Government of the Philippines. BIR Excel Uploader is an offline web application that will convert excel file template to BIR DAT File format generated by BIR Relief or BIR Alphalist Data Entry Application. In addition, printing of multiple BIR Form 2307 from excel file format is supported as well. This video will help you how to submit 1601E Alphalist For Nonvat 1601EQ BIR LINK: Filling date: Quarterly: April 30, July 30, Oct 30, Jan 30. PayrollHero helps complete AlphaList requirements for you. Compute annualized withholding tax easily with our tax examples and Alphalist computation samples. Clarification on alphalist submission Early this year, the Bureau of Internal Revenue (BIR) issued Revenue Regulations No. (RR) which requires the submission of the applicable alphabetical lists of employees and payees on income payments subject to creditable and final withholding taxes. Prescribes the mandatory attachments of the Summary Alphalist of Withholding Agents of Income Payments Subjected to Tax Withheld at Source to tax returns with claimed tax credits due to Creditable Tax Withheld at Source and of the Monthly Alphalist of Payees whose income received have been subjected to withholding tax to the withholding tax.