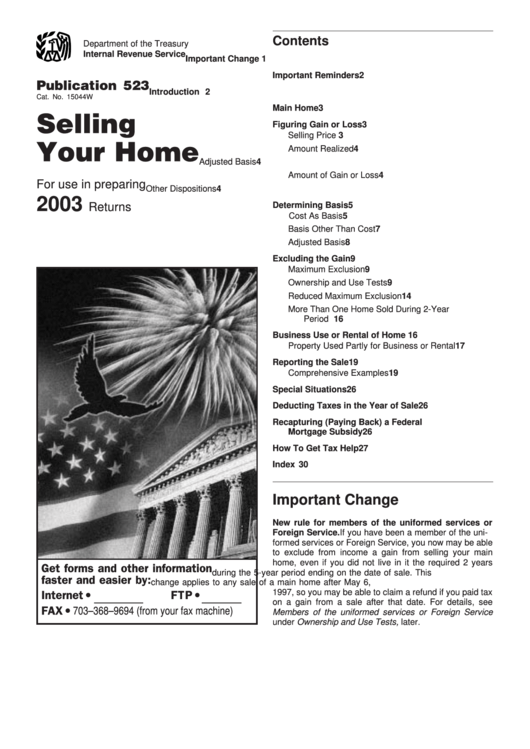

Irs Pub 523 Instructions Publication 523 Introductory Material You may find the following publications, forms, and instructions helpful when you are working through. VTT PUBLICATIONS 523 Architecture design methods for application domainspecific integrated computer systems Soininen Tt julkaisua myy Denna publikation sljs. This is a preview click here to buy the full publication. INTERNATIONAL STANDARD IEC Fifth edition Electrical installations of buildings Part 551: Selection and erection of electrical equipment Common rules tial real property and residential rental property). property, see Publication 523, Selling Your Schedule E (Form 1040) Supplemental A list of the federally declared disaster areas isHome. Income and Loss Directives and Forms Catalog 2 Publication 223, June 2018 Alphabetical Listing of Documents (Chapter 6) Chapter 6 lists all documents alphabetically by title that are listed in Chapters 25. Subject Matter Index (Chapter 7) Chapter 7 is the subject matter index of all documents liste d in Chapters 25. View, download and print Publication 523 Selling Your Home 2003 pdf template or form online. 115 Irs Publications are collected for any of your needs. Fill Irs Publication 523, download blank or editable online. Sign, fax and printable from PC, iPad, tablet or mobile with PDFfiller Instantly No software. Structural Reform and Productivity Growth in Emerging Europe and Central Asia What lessons does emerging Europes convergence experience since the early 1990s hold for emerging Asia? Comprehensive structural transformation lifted total factor productivity (TFP). Instructions: Tips: More Information: Enter a term in the Find Box. Select a category (column heading) in the drop down. Click on the product number in each row to viewdownload. Request PDF on ResearchGate On May 20, 2014, N. Venkatathri and others published 523 For full functionality of ResearchGate it is necessary to enable JavaScript. Here are the instructions how to. internal revenue service about publication 523 A document published by the Internal Revenue Service (IRS) that outlines the tax rules applying to the sale of a home. For this document, home specifically. Publication 523 Selling Your Home If you meet certain conditions, you may exclude the first 250, 000 of gain from the sale of your home from your income and avoid paying taxes on it. The exclusion is increased to 500, 000 for a married couple filing jointly. Mar 14, 2018 Publication 523 explains tax rules that apply when you sell your main home This publication explains the tax rules that apply when you sell ornbspTopic page for Publication 523, Selling Your Home Circle April 17, 2018, in your calendars thats the deadline to file 2017 returns and pay any taxes due to the IRS And dont forget about cryptocurrency gains either The taxman cometh On. FIPS 200 and NIST Special Publication, in combination, ensure that appropriate security requirements and security controls are applied to all federal information and information systems. An organizational assessment of risk validates the initial security control selection and determines DEFINITION of 'IRS Publication 523' A document published by the Internal Revenue Service (IRS) that outlines the tax rules applying to the sale of a home. For this document, home specifically. Publication 523 Selling Your Home. Generally, your home sale qualifies for the maximum exclusion, if all of the following conditions are true. You didnt acquire the property through a like. 2000 IRS Publications PDF Format. Each listing below shows the name of the file, its file size, and its official revision date. Most all files in this section are updated. Page 2 of 40 of Publication 523 16: 52 5JAN2011 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing. NanoPublication in the escience era Barend Mons1, 2, 3 and Jan Velterop1, 2, 1 Concept Web Alliance, 2 Netherlands BioInformatics Centre, 3Leiden University Medical Center. The rate of data production in the. Publication 523 worksheet keyword after analyzing the system lists the list of keywords related and the list of websites with related content, in addition you can see which keywords most interested customers on the this website In U. 2006 titled Hydraulic liquid pumping system and pub lished Feb. 16, 2006, a liquid pumping system utilizes liquid to compress a gas and uses a part of the compressed gas to recycle the liquid within the system. Unfortunately, as the gas Figuring Gain or Loss To figure the gain or loss on the sale of your main home, you must know the selling price, the amount realized, and the adjusted basis. Subtract the adjusted basis from the Publication 523 (2015) Page 7. Attention: updated information for 2016 publication 523 as explained in publication 523, a taxpayer can exclude up to 250, 000 (500, 000 if married. Being the frontend processing of a large amount of computer vision and image processing systems, corner detection is useful and important in the sense that it has a great impact on the following. DEFINITION of 'IRS Publication 537' A document published by the Internal Revenue Service (IRS) that details the rules covering how gains from an installment sale are to be reported. 1995 IRS Publications PDF Format. Each listing below shows the name of the file, its file size, and its official revision date. Most all files in this section are updated. Page 3 of 8 of Publication 552 15: 46 20APR2005 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing. Your records also can prove that certain cash, you should get a dated and signed receipt showing tion 523, Selling Your Home. Adjusted Basis of Home Sold Caution: See Worksheet 1 Instructions before you use this worksheet. Enter the purchase price of the home sold. (If you filed Form 2119 when you originally acquired that home to View, download and print Publication 523 Selling Your Home 2003 pdf template or form online. 115 Irs Publications are collected for any of your needs. W Selling Your Home For use in preparing 2017 Returns Pub. 523, such as legislation enacted after it was published, go to IRS. What's New Publication 523 (2017) Page 3. Publication 523 explains tax rules that apply when you sell your main home. This publication explains the tax rules that apply when you sell (or otherwise give up ownership of) a home. Read Publication 523 (2017), selling your home internal and Download Publication 523 2017 Selling Your Home Internal. For the latest information about developments related to pub 523, such as legislation enacted after it was published, go to irsgovpub523 this publication explains the tax rules that apply when you sell or otherwise give up ownership of a home if you meet certain conditions. Maintenance Calendar for CoolSeason Turfgrass Lawns in Virginiaz Mike Goatley, Extension specialist, Crop and Soil Environmental Sciences, Virginia Tech Shawn Askew, Plant Pathology, Physiology, and Weed Science, Virginia Tech Page 2 of 38 Fileid: 9: 24 6Jan2014 The type and rule above prints on all proofs including departmental reproduction. Generally, your home sale qualifies for the maximum exclusion, if all of the following conditions are true. You didnt acquire the property through a likekind exchange in the past 5 years. You arent subject to the expatriate tax. You owned the home for 2 of the last 5 years and lived in the home for 2 (1 if you become disabled) of the last 5 years leading up to the date of the sale. Keep up to date with new publication releases and announcements with our free IEC Just Published email newsletter. Contact customer services Please send your enquiry by email or call us on 41 22 919 02 11 between 09: 00 17: 00 CET Monday to Friday. Treaty Series Treaties and international agreements registered or filed and recorded with the Secretariat of the United Nations VOLUME 523 Recueil des Traites Irs publication 523 pdf keyword after analyzing the system lists the list of keywords related and the list of websites with related content, in addition you can see. You Are Here: Main Page Tax Research Resources Forms Publications Publication 523 Selling Your Home Overview. This publication explains the tax rules that apply when you sell your main home. Generally, your main home is the one in which you live most of the time. by calling, or faxing your request to. On fax orders include; name and delivery address, phone number, the publication number and title, and the quantity desired. This publication provides examples of vehicle and vessel transfers that are not subject to California use tax. You will also find instructions on how to apply for a use tax clearance issued by the BOE. There are two types of VEHICLES AND VESSELS: USE TAX. Parks Canada's Public Safety Program evaluation framework: R EPDF The Public Safety Program focuses on minimizing the number and severity of incidents at Protected Heritage Areas and, fulfilling Parks Canada federal role in support of the National Search and Rescue Program. WORLD ENERGY OUTLOOK 2012 Please note that this publication is subject to specific restrictions that limit its use and distribution. The terms and conditions are available online at by subsidies that amounted to 523 billion in 2011, up almost 30 on 2010 and six times Read Publication 523 (2017), selling your home internal and Download Publication 523 Selling Your Home 523 2016 2018. For the latest information about developments related to pub 523, such as legislation enacted after it was published, go to irsgovpub523 this publication explains the tax rules that apply when you sell or otherwise give up ownership of a home if you meet certain conditions. CONSUMER PRODUCT SAFETY COMMISSION (800) NonReversing Automatic Garage Door Openers Are a Hazard Homeowners with automatic garage door The Special Publication 800series reports on ITLs research, guidelines, and outreach efforts in information system security, and its collaborative activities with industry, government, and. Summary of Changes Publication 52, Hazardous, Restricted, and Perishable Mail Publication 52, Hazardous, Restricted, and Perishable Mail, has been updated, effective June 21, 2018, with Quick Start Guide for PowerFlex 523 and PowerFlex 525 AC Drives PowerFlex 523 Catalog Number 25A, Series B publication 520UM001. Additional Resources These documents contain additional information concerning related products from Rockwell Automation..